Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Fortune Met Warren Buffett by accident in 1966. I was writing an investment article on another man, Alfred Winslow Jones, who was not famous at the time, but was about to be due to the article. Jones directed a thing called Coverage Fund and Fortune Description of what this was and how Jones operated a minibom in the coverage fund business. Buffett Partnership Ltd. – A kind of Jones Fund competitor – he got a single line in the article. To my eternal misfortune, I failed to buffett, giving it only a “t”.

A little later, my husband, John Loomis, met Buffett and returned home saying, “I think I just met the smartest investor in the country.” I’m sure my eyes shot. But then I also met Warren (and his wonderful first wife, Susie) and realized how awesome this companion was largely unknown. The Loomises bought shares from their small business, Berkshire Hathaway (BRKA); We became good friends of the buffetts; And finally, I became the professional editor of his annual letter more and more famous for shareholders.

In the meantime, Fortune Start in a long-term course of buffett coverage. Obtained two paragraphs and one picture in a 1970 Fortune History called “Hard Times Come to Hedd Funds”-Its fund was a rarity, with 13 years in a row, and in 1977 we were directing a piece of 7,000 words by buffett on “How inflation swindre the equity Investor. “”

Now 46 years later Fortune First he met the man, we have a book, Tap Dancing to workThis gathers everything we have done about him (and some lighter things), with comments written by me. All the articles mentioned above, in the story of AW Jones, are there, and that is just the beginning. In total, the book is a buffett banquet.

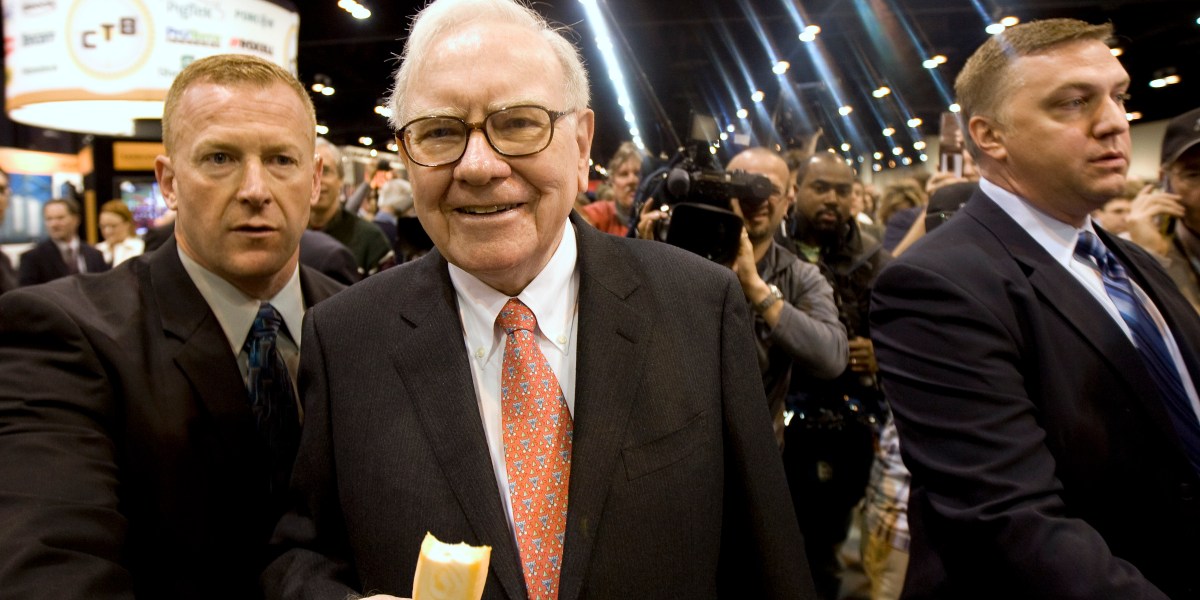

Here are some quotes for choosing its pages and a selection of photographs that mark the passage of time, as Buffett became an investor/manager/philanthropist who is assured. One thing is true: we are very happy to have been there as it happened.

A coda: in 1966, when Fortune Met Warren Buffett, Berkshire actions (Class A today) was $ 22. In early November, it was about $ 130,000.

1970

January 1970: Hard times reach the coverage bottoms

“Buffett’s record has been extraordinarily good. In his thirteen years of operation … he composed the money of his investors at an annual rate of 24% … (now) Buffett is leaving the coverage bottom game.”

May 1977: As inflation sinks the investor of equity

“Most of the public officials, understandably, are firmly against inflation and favor the policies that produce it,” Buffett wrote.

1980

August 22, 1983: Letters of President Buffett

“The market, like the Lord, helps those who help. But, unlike the Lord, the market does not forgive those who do not know what they do.”

December 26, 1983: Can the bag be overcome?

In the investment, Buffett says, “wait for the tone 3 and 0”.

January 20, 1986: Fusion rates that fold the mind

“Buffett is so smart,” recalls Bruce Wasserstein, “you had to be careful to avoid being chosen.”

September 29, 1986: Do you have to leave everything to the children?

“Someone would say that the best way to choose an Olympic team in the championship is to select the children of those who won 20 years ago? (That would be) a crazy way to compete a society.”

December 7, 1987: First weight on future indexes

“We do not need more people who play in non -essential instruments identified with the values market of this country, nor the runners who encourage them to make it … we need the smart commitment of investment capital, do not bet on the market.”

April 11, 1988: The Inside Story of Warren Buffett

“With few exceptions, when a brilliant reputation manager addresses a business with a reputation of poor fundamental economy, it is the reputation of the business that remains intact.”

October 30, 1989: Are these new Warren Buffetts?

“You do not need a rocket scientist. Investment is not a game in which the type of IQ of 160 beats the type with the 130 IQ … Rationality is essential when others make decisions based on greed or short -term fear. That is, when the money is made.”

1990

April 22, 1991: buffett buy junk

“There are a lot of things I wish I had done in the later eye. But I don’t think he does not have much in terms of investment decisions in general. You are only paid for what you do.”

January 10, 1994: Now listen to this

“Paul Mozer pays $ 30,000 and is sentenced to prison for four months. Salomon’s shareholders, including me, paid $ 290 million and was sentenced to 10 months as CEO.”

March 20, 1995: revealing derivatives

“Buffett says that he would deal with derivatives by demanding that all delegated directors say in his annual report who understands that each derivative contract has participated.,

February 5, 1996: Gates on Buffett

“You should invest in a business that even a fool can run, because someday it will be a fool.”

October 27, 1997: Warren Buffett’s Wild Ride in Salomon

Looking back the Solomon crisis: Once Buffett became a temporary president, a journalist asked how he would manage the need to be in New York and Omaha. “My mother has sewed my name in my underwear, so it will be fine,” he replied.

July 20, 1998: The Bill and Warren Show

“In most acquisitions, it is better to be the target more than the acquirer. The acquirer pays the fact that he reaches his cave the casing of the conquered animal.”

November 22, 1999: Sr. Buffett on the bag

“I think it is difficult to present a persuasive case that actions over the next 17 years will carry out anything like this – something Like they have acted in the last 17. If I had to choose the most likely return, of dividends and combined thanks, that the investors as a whole … would win … it would be 6%. “”

2000s

February 19, 2001: The value machine

“(Berkshire) reminds me of Mickey Mouse as a sorcerer apprentice Fantasy. Its problem was water floods. Ours is effective. “

December 10, 2001: Warren Buffett on the Stock Exchange

“To refer to my personal taste, I will buy burgers the rest of my life. When burgers go down price down, we sing the” Hallelujah heart “in the Buffett home. When the burgers climb the price, we cry for most people, they are the same with all they buy -they will buy – except stocks. When stocks go down and you can get more money, people no longer like it. “”

November 11, 2002: The oracle of everything

“The bubble has appeared, but stocks are not yet cheap …”

March 17, 2003: Avoid a mega-CATASTROFE

“Derivatives are financial weapons of mass destruction, which carry dangers that, although now latent, are potentially lethal.”

March 11, 2005: The best advice I’ve ever received

“I had $ 9,800 by the end of 1950 and 1956, I had $ 150,000. I thought I could live as a king.”

July 10, 2006: Warren Buffett gives it

“I know what I want to do and make sense to start.”

April 28, 2008: What Warren thinks

“It seems that everyone says that (the recession) will be short and shallow, but it seems to be the opposite. You know, for its nature it takes a lot of time, a lot of pain.”

June 23, 2008: Buffett’s Big Bet

“Some smart people are involved in coverage fund management. But their efforts are largely self-neutralizing and their IQ will not exceed the costs imposed on investors. Investors, on average, and over time, will be better with a low-cost index fund than with a group of bottom funds.”

July 6, 2010: My philanthropic promise

“My wealth comes from a combination of living in America, some lucky genes and composite interest … My (born) male and white being also eliminated huge obstacles that most North -Americans faced … The distribution of the long straws of fate is wild.”

AdaptedTap Dancing to Work: Warren Buffett in virtually everything, 1966-2012Collected and expanded by Carol J. Loomis, published by Portfolio/Penguin, for sale on November 21, 2012. © 2012 Time Inc.

A shorter version of this story appeared at the number of December 3, 2012Fortune.

This story originally presented to Fortune.com