Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

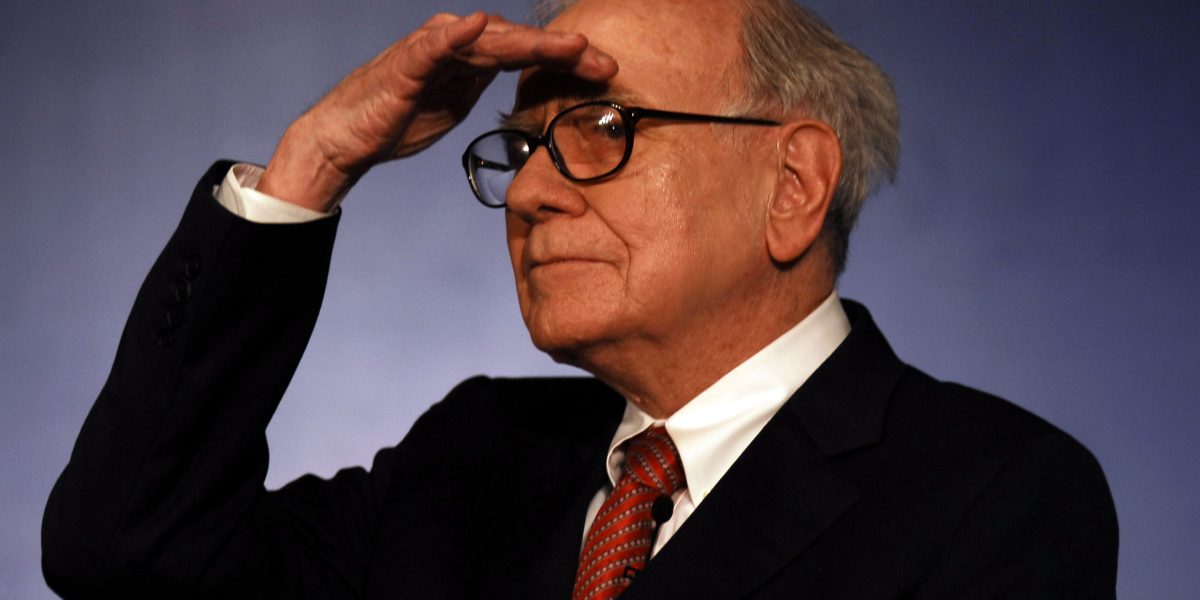

Berkshire Hathaway CEO Warren Buffett requested that he share lessons and fundamental lifestyles for young investors, and his response did not involve the collection of actions or the best long -term assets.

During the annual meeting of Saturday’s shareholders, he talked about what kind of people the investors should be throughout their lives.

“Whoever associates is enormously important and do not wait for you to make all the decisions about this,” said Buffett. “You will have your life in the Directorate -General of the people you work with, you admire, who become your friends.”

He added: “There are people who make you want to be better than you and who want to hang out with people who are better than you and you feel that they are better than you.”

This is different than to follow someone who makes a lot of money and trying to copy what they do, explained Buffett.

Instead, he said he tried to be around smart people who can learn. In addition, people should return any help offered by others, he added.

“So you get a composition of good intentions and good behavior and, unfortunately, you can also achieve the reverse in life,” said Buffet.

He also urged people to find a profession they would do if they did not need the money and warned against associating with those who “tell you to do something that you should not do.”

Buffett added that it is interesting that many workers in the investment world leave the business after they have made a lot of money.

“You really want something you stay, you know, if you need the money,” he said.

Answering a separate question from a young investor who asked what to do to be hired in Berkshire Hathaway One day, Buffett replied, “Keep a lot of curiosity and read a lot.”

As for the actual investment, it has maintained in the past that people should not imitate what they do with the portfolio of actions of Berkshire – Almit his legion of followers – and instead should put his money on a S&P 500 index fund.

This story originally presented to Fortune.com