Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The company’s final markets and its delay continue to grow strongly.

Expenditure on data centers and semiconductor manufacturing plants is still robust.

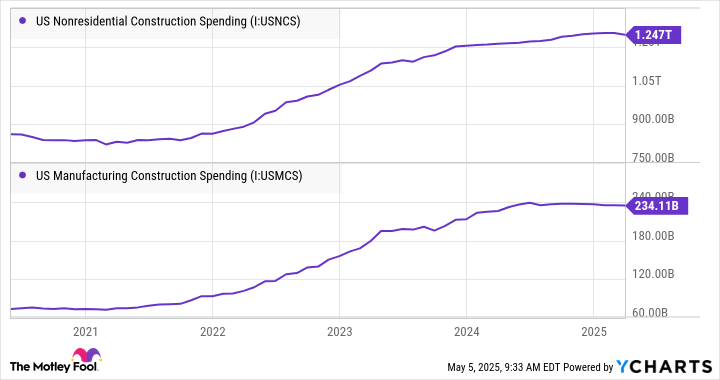

The rehabilitation of manufacturing in the United States would benefit the comfort systems.

Shares to US comfort systems (NYSE: Solving) increased 23.3% in April, according to data provided by S&P Global Market Intelligence. The measure occurs when the company’s first quarter revenue relieved the fears that its growth would have been reduced and left their assessment.

Comfort Systems is a mechanical and electric contractor. A little more than three quarters of their income comes from the mechanical side (heating, ventilation, air conditioning, plumbing, pipes, controls, etc.) and the rest of the electricity (installation and service of electrical systems).

Where to invest $ 1,000 right now? Our analyst team just revealed what they think are the 10 best stocks to buy right now. Continue »

The following graph explains its price of booming shares (up to an incredible 1,250%). As you can see below, it has been the north investment – data centers To support the growth of artificial intelligence applications (AI).

Fear was that this growing growth began to be delayed by 2025. However, the company’s first quarter revenue, published in late April, helped to dissipate this notion, not less than the company reported $ 6.9 billion at the end of the quarter compared to almost $ 6 billion at the end of 2024.

In addition, comfort continues to see strength in technology spending (including data centers and semiconductor manufacturing plants), increasing 30% compared to the same period last year, it now includes 37% of total revenue.

Discussing his final markets on the results call, CFO William George said about the data center’s capital spending: “There is no sign of coverage in the demand for electricians, pipes and plumbers to help build data centers and, frankly, many other things.”

It is a reassuring comment, because there were concerns that the investment issue of the AI/Data Center may have problems due to a potential slowdown in expenditure.

The company’s backlog continues to grow and Wall Street is waiting for another year of two -digit revenue in 2025. In addition, there is a long -term growth opportunity that comes from the potential of manufacturing in the United States, either through new construction or expansions at existing facilities. Although comfort is not immune to a possible economic slowdown caused by commercial conflicts that reduce capital spending in facilities, it seems a probable winner if President Donald Trump manages to revitalize the US industrial base.