Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The value of gold dates back to the early years of humanity. It is still a safety asset to this day.

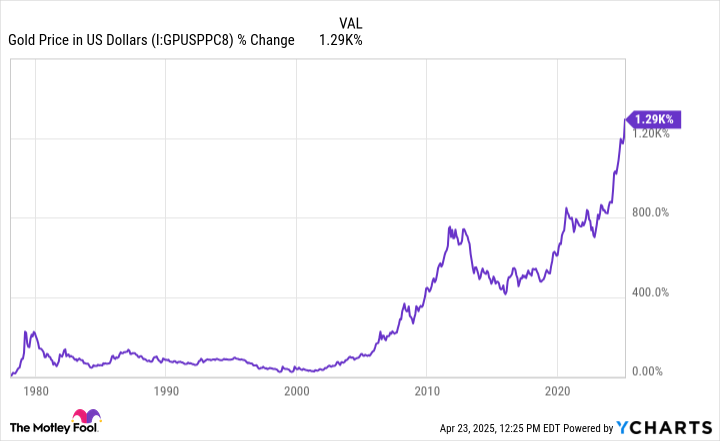

The increase in uncertainty on the stock market has led to a literal gold rush. Gold, with a price of US dollars, has increased almost 24% over the last year. But zoom, and gold increases more than 900% since 2000, favoring the S&P 500 489% of the index on this section. Newmont Corporation (NYSE: No)The largest gold mining company in the world has increased more than 40% year -on -year.

Where to invest $ 1,000 right now? Our analyst team just revealed what they think are the 10 best stocks to buy right now. Continue »

Should you invest in Newmont Corporation today or has the opportunity already happened? Here is what you need to know.

Gold is a beautiful metal that comes from the ground. When you buy physical gold or a ETF resting in goldYou have any of the existing gold supplies. Buying Gold Mining Stocks provides you with equity in reserves, gold that is still on the ground. Newmont is the largest gold company in the world, but also produces copper, silver, zinc and lead.

Newmont’s operations cover the world, which cover the two mining projects it has and operates directly, as well as those that indirectly manages through joint companies and other collaborations. Newmont Corporation is similar to a company that is perforated for oil. Its financial performance depends a lot on two factors:

The amount of gold and other metals it produces.

The predominant market prices for these metals.

People invest in gold for several reasons. Its long -term value and limited offer can turn gold into a popular fence against inflation. In addition, gold is often with great demand at uncertain moments, and it is fair to say that Trump Administration’s fare ads in early April have understood market prospects, even if the United States has resorted to or have stopped some of these policies.

Historically, gold prices have passed through boom and boom cycles. You can see this pattern repeat several times between the end of the 70’s and today:

Although the long -term management is up, gold prices have not been constantly reliable during long periods of time. It helps to explain why Newmont Corporation has returned a total of 240% since 1989. No one knows what the future is, but the story shows that simply buying and celebrating Newmont Corporation has no results.

The calendar of when you buy is crucial.