Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Unlock Free

Roula Khalaf, publisher of the FT, selects her favorite stories in this weekly newsletter.

The writer, a collaborating publisher of FT, is the CEO of the Royal Society of Arts and former Economist in Chief of the Bank of England

Panic: noun. A person or a panic party, who reacts with events in a weak and stupid way. Repeal.

This neologism has barely a month. There is an irony, a great one, that in a week of the invention, its author (the President of the United States) had become a member who carried letters from the Panician party. Only 24 hours of drop in the “Liberation Day” was needed to give way to the “quarterback”, with a 90 -day fare pause.

However, the issue raised by the President of the United States is still relevant now as then. Is the reaction of financial markets, politicians and media to their fare ads over? The catastrophic 24 hours of the day of the financial markets and the media, and a political class usually declared the end of the world, in panic?

The impact of the rates and, in particular, the fear of an unknown climb on them, is in a very real important sense. If a weapons race seized, one day of liberation could presume a decade or more of hibernation in trade and world growth. The arc of trade history has been inclined, which is regularly alarming into the dark.

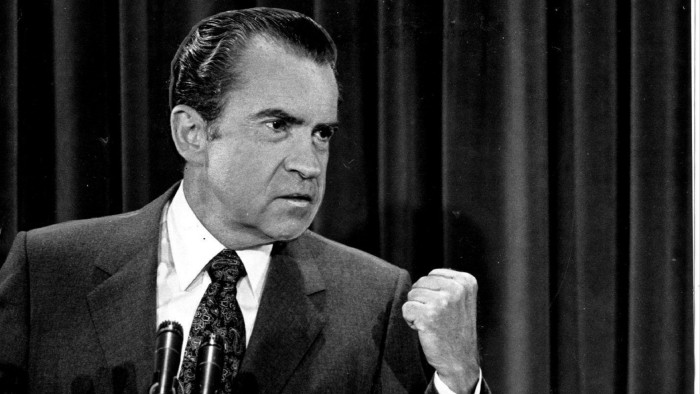

The fares that emanate from the United States have occurred in a routine half-century cycle for the last 250 years: 1789, 1828, 1890, 1930, 1971. Each left a lasting macroeconomic scar-in the penultimate case (the Smoot-Hawley’s rates) that deepened the Grand Depression, in the final case (the “Nixon Collar”) inflation. Both are remembered as big for the wrong reasons.

In half a century, with the now larger and significantly more intertwined world trade, the scars of a 2025 fare shock could be expected to be deeper. Economic forecasts dyed blood last month show, with a U.S. recession now a launch of coins. Also, in the financial markets, with more than 6 TN of lost dollars of the world market markets and involved volatiles that had increased triple.

On the other side of this argument, however, today no doubt that the cradle of the cat’s overall supply chains cannot be unveiled without years of re -engineering at catastrophic cost. The same inter-knowledge of world trade and the costs of disconnection are the best possible bastion against fare climbing.

The excess sensitivity of financial markets applies a double blockade. In telescopiar and amplifying these costs, they serve as a real -time discipline device to politicians who claim that they can cause short -term pain. This makes the capitulation faster than in the past. Smoot-Hawley rates lasted four years, the Nixon rate four months. The worst of Trump’s rates lasted just a week.

The rates could be climbed again. But once bitten, twice shy. Last month, he leaves a U.S. President as a psychologically healed, psychologically skinned skin as a business and financial markets he has had in Thrall. The irresistible force of self-importance helped to cause the United States Tariff Rise, but the motionless object of self-conservation will be its undoing.

For all the rhetoric of a new world order, then, the global average reversal forces can be in fact stronger than ever. A new financial order was widely expected after the world financial crisis. Twenty years we have seen a certain redirect of flows, but there is no great deployment. World trade can follow a similar path, if there is something fortified by recent events, perhaps even with China as the new unlikely champion.

In the meantime, despite the external expressions of dismay, last month it has been due to many world leaders. The trade war and the conversation of a new world order are breathing in indicating and unpopular regimes (Xi Jinping in China, Emmanuel Macron in France, Vladimir Putin in Russia), providing alternatives prepared for the oven for new ones (Friedrich Merz in Germany, Mark Carney in Canada, Keir Starmer in the United Kingdom).

However, the exception of China, the climb solemnly declared by many leaders has so far been largely semantic and non -noun. We have had a month of reciprocal rhetoric instead of rates. If medium reversal and self -conservation forces remain strong, they can (i) continue.

A time of delobalization is possible. Trump’s rates can still mark a new commercial chapter. However, the arc of history is more likely to be inclined to light, with recent events as a non -heading chapter chapter. What we have witnessed is a panic more than a heart attack for the world economy, in fact, self-stabilizing. In an excessive time without a rudder, the rise of the Panicans can save us from ourselves.