Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Coca-Cola and Pepsico are basic consumer products.

Although both Coca-Cola and Pepsico do drinks, one has a much more diverse business.

Coca-Cola seems much more attractive to Wall Street today, but that does not necessarily mean that you have to buy it.

Beverage giants Coca-Cola (NYSE: KO) and Pepsico (NASDAQ: PEP) Have a lot in common. Some investors could consider them interchangeable investments, but they are not.

Right now, one is much more attractive than the other, which is why you may want to be selective if you want to buy one of these stocks right now.

Where to invest $ 1,000 right now? Our analyst team just revealed what they think are the 10 best stocks to buy right now. Continue »

Coca-Cola and Pepsico are both Basic consumer products producers. These types of companies generally manufacture products that are regularly consumed, that is, repeated purchases at frequent intervals.

And the costs of the consumption staples are usually quite low, so consumers do not usually worry about the cost and, on the other hand, focus more on their personal preferences. In addition, most of the products in the segment fall into the field of need, so they must be bought, regardless of the market environment or the economic context.

That is why consumption consumption actions such as Coca-Cola and Pepsico are seen as defensive investments. Coca-Cola is a pure game Drinking Manufacturer. Pepsico makes drinks, but also makes salty snacks (frito-lay) and packaged products (quaker oats). In this way, Pepsico is a much more diversified business.

That said, both Coca-Cola and Pepsico have at their disposal a global imprint and a powerful distribution, marketing and R&D tools. Thus, although they are not interchangeable, they are very similar in some important ways.

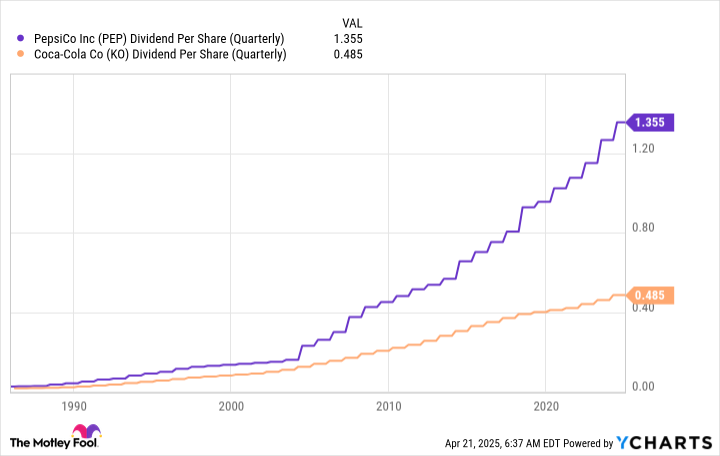

One of the most important ways that Coca-Cola and Pepsico are similar is their reliable long-term performance. This stands out better for the state of each company as a king of dividends. This group of highly elite companies has increased its dividends annually for at least 50 consecutive years. This does not happen by chance, it can only happen if a company has a strong business model that runs well in both good and bad times.

Interestingly, the dividend is where the largest difference between these two consumer giants begins to appear. The average action of consumption staples has a yield of 2.5%, Coca-Cola dividend performance is 2.8%and Pepsico’s performance is around 4%. It is clear that Pepsico is the most attractive income option.