Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

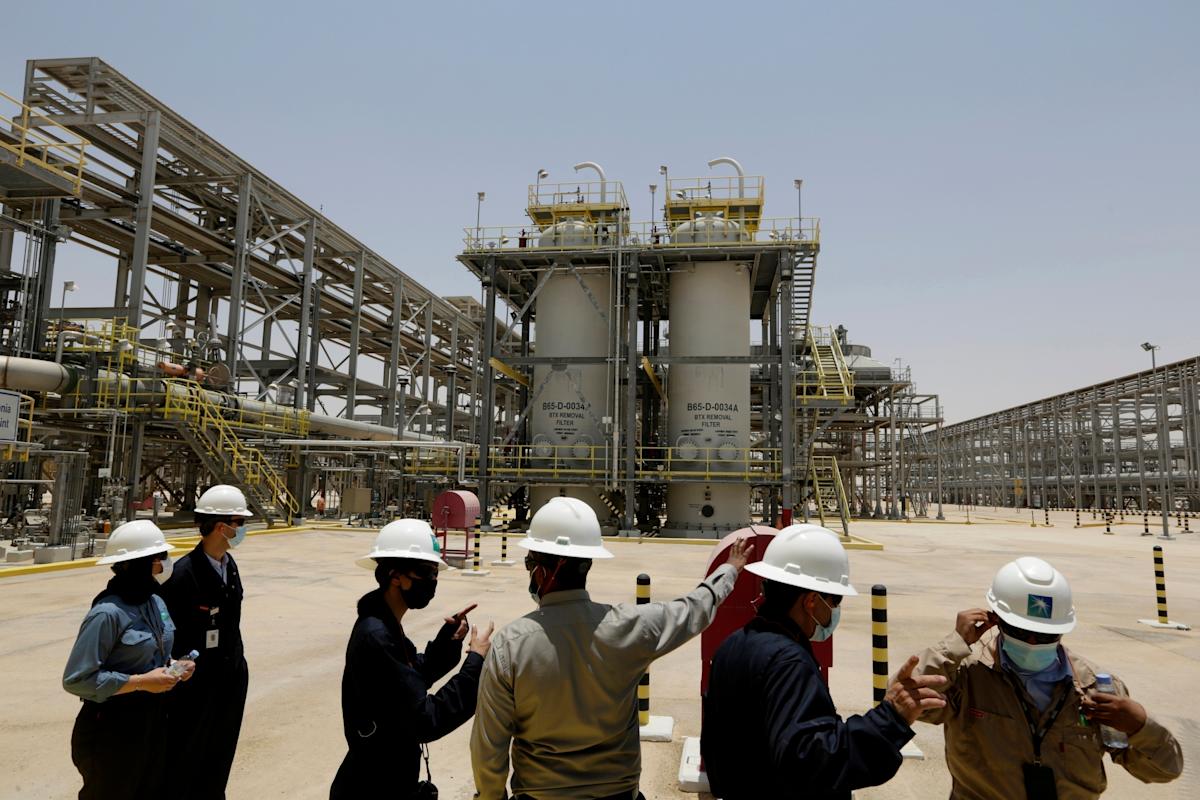

Dubai, the United Arab Emirates (AP)-the State Giant of the State of Saudi Aramco Aramco recorded benefits of the first quarter of $ 26 billion on Sunday, 4.6% compared to the previous year, as the fall in world prices for oil diminished the multi-perching development plans of the kingdom.

Aramco, formally known as Arabian Oil Co., had revenue of $ 108.1 billion during the quarter, the company reported in a presentation on the Riyadh stock exchange. The company recorded income of $ 107.2 billion and profits of $ 27.2 billion in the same quarter last year.

Saudi Arabia has promised to invest $ 600 million In the United States during the term of President Donald Trump.

Trump, who played Riyadh on Tuesday on his first official foreign trip since he returned to the Oval Office, said in January that he wants this number to be even higher, around $ one trillion.

Meanwhile, the de facto Saudi ruler, Prince Colonel Mohammed Bin Salman, has his views on a $ 500 million project to build NeomA vast futuristic city in the desert along the Red Sea. The kingdom will also need new stages and infrastructures that cost tens of billions of dollars for 2034, when Saudi Arabia will be welcomed The World Cup.

The announcement of the results of the first quarter of Aramco comes as the OPEC+ Alliance has increased oil production. The oil cartel has agreed to increase production by 411,000 daily barrels next month, as the uncertainty promoted by the United States has been dragged by the Middle East markets. This means that Saudi Arabia will probably have to borrow or spend reserve funds to finance the expensive goals of Prince Colonel.

Aramco shares traded more than $ 6 per action on Sunday, below a maximum of $ 8 last year. It has dropped last year as oil prices have been reduced and in recent months.

“The world commercial dynamics affected energy markets in the first quarter of 2025, with the economic uncertainty that affected oil prices,” said Aramco’s president and CEO, Amin H. Nasser, in a statement.

Benchmark Brent Crus traded on Friday to more than $ 63 the barrel, dropping out of higher than $ 80 in the last year.

Aramco has more than $ 1.6 trillion, making it the sixth richest company behind Microsoft, Apple, Nvidia, Amazon and Alphabet, the Google owner. Analysts see the company as a leader of the world’s oil markets.

A fraction of Aramco quotes Tadawul, while the company’s part is owned by the government of Saudi Arabia, helping to pay the expenses and to add to the wealth of the royal family to the Saud of the country.