Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

We met with a bullish thesis to Novo Nordisk a/s (NVO) on the replacement of Kontra Investments. In this article, we will summarize the thesis of bulls on NVO. Novo Nordisk’s Fuer A/s (NVO) was listed at $ 67.74 from May 12th. The P/E NVO was 19.18 and 16.50 respectively according to Yahoo Finance.

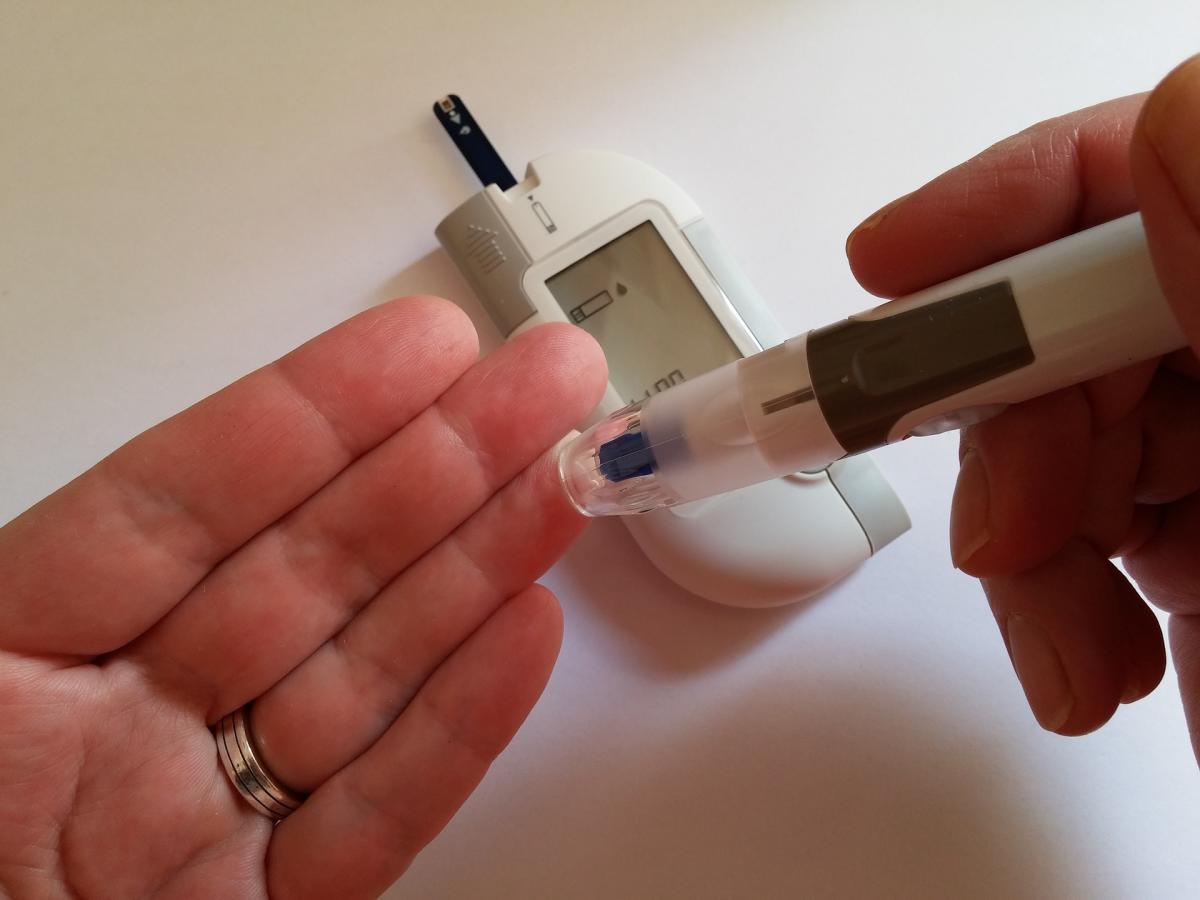

Pixabay/Public Domain

Novo Nordisk performed a sturdy performance in the first quarter, marked by a 19% increase in revenue at Dissh Kroner (18% at constant change rates) up to 78.1 billion DKK and a 22% increase in operating profit to 38.8 billion DKK. These results were driven by disciplined cost control and the strong demand for their diabetes and obesity treatments. Net revenue reached 29.0 billion DKK, while free cash flow reached 9.5 billion DKK, allowing aggressive capital returns for a total of 36.7 billion DKK through dividends and repurchase. Diabetes and obesity care segments continue to promote the growth of the company, contributing 73.5 billion DKK sales, 21% to constant exchange rates. Care for obesity alone increased 65% to 18.4 billion DKK, propelled by Wegovy, who, despite facing short-term heads in the United States from composite semaglutive alternatives, is expected to be strongly bounced through the Cash Pay Payment Model and CVS health access from July 2025.

Although the softness of the US market due to the cheaper GLP-1 drugs has temporarily affected the impulse, it is expected that the increase in the FDA scrutiny and the alignment of narrower payers will redirect the patient’s volumes to Wegovy. The international expansion is accelerating, with Wegovy now launched in 25 countries, from 20 to the beginning of this year. Novo maintains its global domain of the GLP-1 market, which has a two-thirds share, anchored by Ozempic and Wegovy flagship products. The company’s innovation engine is still vital, with new promising therapies such as the Cagrisema, which decreased 15.7% of the weight loss in trials, on the court for approval of 2026 and an oral version of the semaglutide with 16.6% weight loss expected the authorization of the FDA, unblocking new market segments between patients with patients with patients.

Novo’s long -term financial prospects are still convincing, with 2025 guidance, which provides for sales growth of 13 to 21% and the growth of operating profit from 16 to 24%, even after accounting for the volatility of the United States. The margins have been expanded to 49.7%, reflecting the cost efficiency between SG & A R&D. With the support of DKK 140 billion in manufacturing investments since 2021, Novo has been positioned to meet the growing GLP-1 overall demand on scale. The company also continues to prioritize ENS initiatives, with significant progress in gender diversity and access to global treatment. EPS management projects could reach $ 50 until 2029, solidifying Novo Nordisk’s presentation as a high quality lasting compost.