Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

We recently published a list of 10 technological actions that Trump’s Republican partner bought in the middle of the market routine. In this article, let’s take a look at where to Adobe Inc. (NASDAQ: Adbe) It is against other technological actions that Trump’s Republican partner bought in the middle of the market route.

Tracking investments in politicians in actions is a good way to determine what actions can receive a favorable policy treatment by the Government. If the committees are set, these politicians are located and the political issues they deal with, investors can obtain information on what to follow for certain industries.

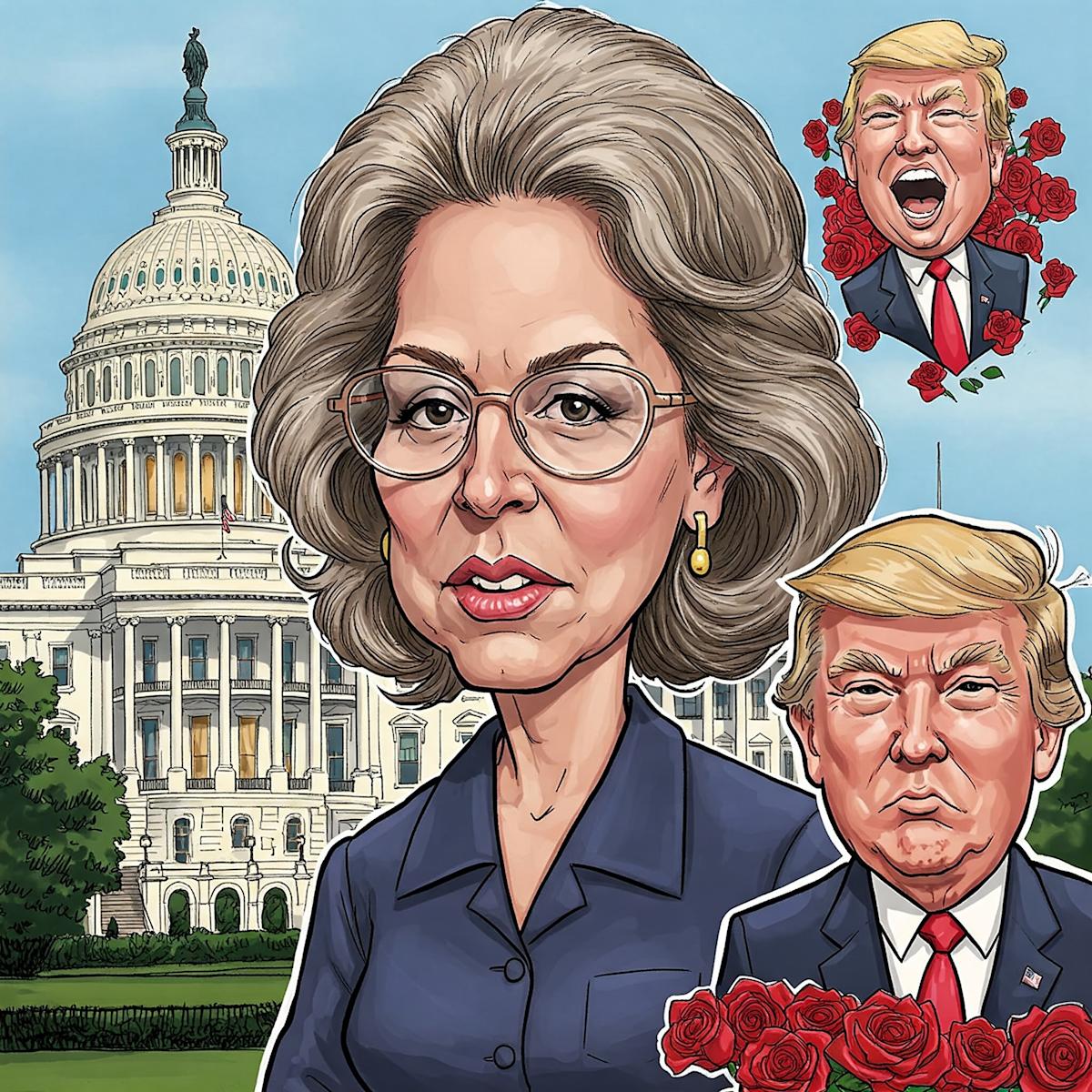

The Stock Exchange Law requires that these politicians report their shops within 45 days after they are located. These publications are made public, making the process as transparent as possible. While we looked at some recent publications, we observed certain politicians who stood out. One of these politicians was Trump’s Republican partner, Marjorie Taylor Greene, who bought shares on April 3 and 4, two days when the S&P lost more than 10% of its value.

Some of these stocks have already recovered from their minimum levels that day, showing how Mrs. Greene was able to buy shares that were quickly recovered despite the wider market that continued to fight.

To present our list of ten technological stocks that Trump’s Republican partner bought in the middle of the market route, we looked at the recent two archives of the Republican on April 7 and 11, where he reported these shops. Then we classified them for the number of coverage funds containing the company’s actions on their portfolio.

Why are we interested in the stocks that cover the funds? The reason is simple: our research has shown that we can overcome the market by imitating the best stock options for the best coverage funds. The strategy of our quarterly bulletin selects 14 stocks of small layers and large layers each quarter and has returned 373.4% since May 2014, surpassing its reference point at 218 percentage points (Check out more details here)).

Number of coverage fund holders: 117

Adobe Inc. (NASDAQ: ADBE) Operates in digital experiments, digital media and advertising and advertising segments. It offers training services, technical support, consulting, customer management and learning.

KeyBanc Capital Markets updated the technology firm last month of weight to the weight of the sector, quoting the reduced risk and a fair assessment. Jackson Ader’s analysts think that there is a limited possibility of decreasing and predicting stable foundations throughout the exercise.

At the end of March, Adobe Inc. (NASDAQ: ADBE) received another update for Argus. Quoting the potential for the growth of two digits in the benefit by action and the income fueled by its generative artificial intelligence tools, Argus reiterated its purchase rating to the technological giant. Argus also maintained his price of $ 600 in shares.