Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

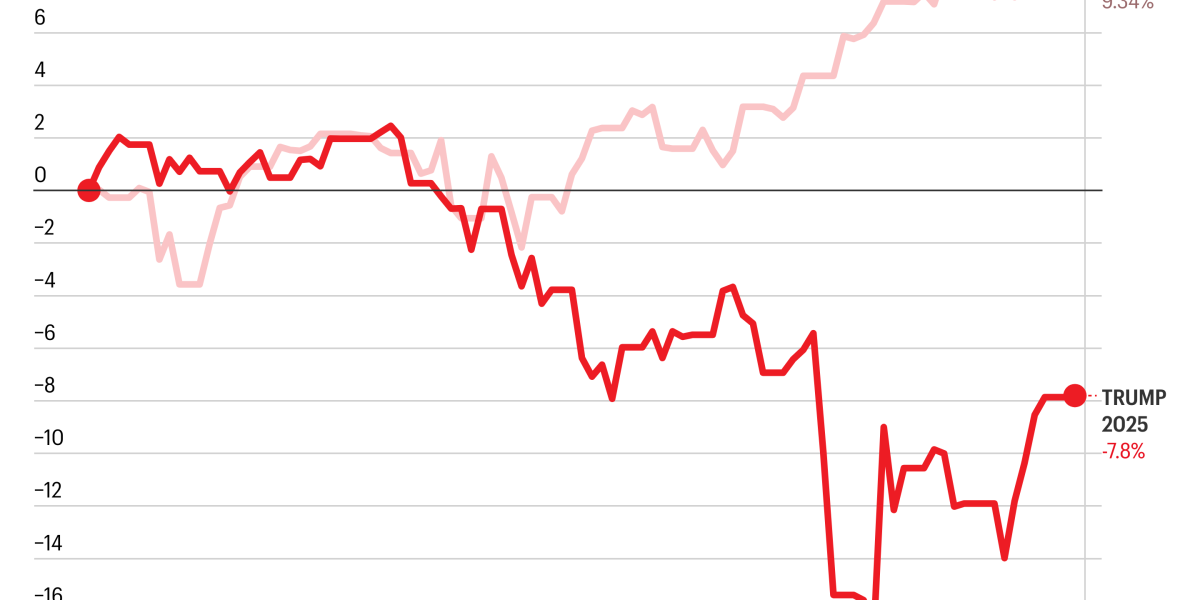

The first 100 days of President Donald Trump in the White House have been historically bad for the stock market.

From January 20 to the end of April, the S&P 500 has dropped almost 8%. This is the worst start to a presidential mandate since Gerald Ford took the reins of the executive branch after Richard Nixon resigned in 1974. And it is the fifth first start since 1928, the oldest date for which S&P Global Market Intelligence has data.

(While the S&P 500 of its current incarnation has been existed only since 1957, S&P Global Intelligence has comparable data that dates back to 1928 of the previous stock market rates that Standard & Poor has developed.)

The dimly brilliant performance of the securities market was only ahead of the terms of Franklin D. Roosevelt in 1933 and 1937, during the depths of the Great Depression. It also surpasses both Ford and the beginning of Nixon’s second term in 1973, when the United States faced another economic crisis in the form of a stagflation.

Check this interactive graph at Fortune.com

Add -There the Dollare stumbles And a withholding of the traditional investment of safe-had of treasure notes, and the first 100 days in the markets have been restless for investors.

“The U.S. and dollar securities market have spent worse for the last hundred days that have been released during the first hundred days of the rest of the presidential terms since 1980,” John Higgins, a capital markets economist, wrote on Monday in a research note entitled: “The next 100 days will not be as turbulent as the last?”

Meanwhile, in the first 100 days of Joe Biden’s return to the Oval Office, as the world markets bounced off the damage caused by Covid-19, the S&P 500 jumped more than 9%. This is the third best start for a chief commander since 1928.

Check this interactive graph at Fortune.com

The market market market comes when Trump’s fare plans have sown economic chaos last month. In early April, the President requested a 10% reference line on all imported goods and instituted additional “reciprocal rates” to almost 60 countries and territories, as well as the European Union. He also promoted a fare battle for China and increased taxes on the imports of the People’s Republic to 145%.

“The U.S. lost billions of dollars a day in international trade under the fall Joe Biden. Now I have touched this tide and I will make a fortune, very soon,” Trump, “Trump” published On Monday to social truth, its own social media application.

U.S. stock markets did not respond well to the “tide” Trump derivation. After the “Liberation Day”, when the President first announced his suite of historically Severe rates on April 2, the S&P 500 closed 10% in a two -day period. “Never before has an hour of presidential rhetoric so many people,” wrote the former Treasury Secretary Larry Summers in a position over XShortly after Trump showed a cardboard graph that exposed an increase in taxes on foreign imports.

Check this interactive graph at Fortune.com

The President also erased the federal government with the help of Tesla CEO Elon Musk, the de facto chief of the Government Efficiency Department (DOGE), a new organization designed to eliminate “waste, frauds and abuses”. Analysts have been concerned about how federal spending cuts can affect private contractors. “It is a massive source of income for many different types of companies, not only government companies, but also private companies,” formerly Abigail Blanco, an associate professor of economics at the University of Tampa I talked to Fortune.

While the President’s policies have a large part of the turbulence of the market, it is not the only cause of the fall. Stocks contributed to historically high values at the end of Joe Biden’s presidency, directing some economists to worry about that the market was overrated or overloaded in a A good handful of technology companies. And the bombo of ai that drove much of the exuberance of the market was immersed when China DeepSeek He launched a model of great language earlier this spring that coincided with Openai, drying trillions of the market lid of the US -based companies in the United States.

This story originally presented to Fortune.com