Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Unlock Free

Roula Khalaf, publisher of the FT, selects her favorite stories in this weekly newsletter.

The reforms found in the Isa are at the Cross of the Chancellor, with the treasury wait To launch a consultation on the future of savings and investment accounts without taxes.

Yippee said absolutely anyone, apart from the UK’s fund pressure groups and the investment platforms that have launched this debate. Handing on some of the 300 million pounds of cash in cash would massively benefit their businesses, but Rachel Reeves must ensure that the next consultation focuses on what would really benefit consumers in the United Kingdom.

The ISAs allow individuals to save or invest up to £ 20,000 annually from taxes, divided between cash and actions in any way they choose. Industry proposals include reduction of cash to £ 4,000 in the wrong belief that you can force people to invest, not to mention the driving tax reductions towards the actions of the contributions in the United Kingdom.

The Chancellor often talks about his desire to create a greater culture of detailed investment in the United Kingdom. Seemed triumphant this week after persuaded with force 17 great pensions To bomb a dear of 25 million pounds of retirement saving of workers in companies in the United Kingdom, infrastructure and property in the late decade.

Could you promote the future or partly restrict the taxes without investment taxes on UK shakes in the future? I really hope no. Last year, the labor force significantly affected the previous government’s plans for £ 5,000 “British Isa” Bonus. It may be tempted to rethink it.

The simple fact is that any Isa reform must eliminate barriers to investment, not to create more.

It is estimated that 6 percent of the UK adults have a stock and shared isa; A shockingly low number, especially since the financial regulator believes that 4.2 million consumers have more than £ 10,000 of investigable assets mainly or completely in cash. This is in the heart of what the consultation should treat.

Cash savings are vital, but above a certain level, policymakers should encourage long -term investments that may lead to better performance. The question is that the cash subscription will be achieved?

No! The “correct” level of cash depends on your individual circumstances, which vary greatly throughout your life. Tarnet the most popular savings product in the United Kingdom, reducing the quota and most cash savers Isa would only adhere to their money in another cash savings account instead of seeking it, according to a recent AJ Bell survey.

In contrast, the consultation should face the silenced structure of the Isa market, with cash and actions preserved in separate products led by different types of companies. If cash saving decided to invest money, this would require opening a separate isa product (probably with a different supplier) and organizing a transfer to preserve tax benefits. Simplify this process and support the creation of “hybrid” isa designed to contain both in cash and the actions would facilitate this transition.

As I discussed here beforeIf we want more long -term cash savers to make the change, the response lies in the education of the masses on investment. Treasury should look As gene z leads the way. 38 percent of 18-25 years in the UK report by investments; the highest proportion of all age groups according to investigate of Platforum. The amounts of money invested are small now, but their participation and desire to self -educate are fostering trends.

Investment applications such as trade 212 and Moneybox are packaged with video content designed for Tiktok. The ability to possess and market actions in the technological giants of the United States is a huge attraction for young investors, whose digital lives are already dominated by these companies. Although regulators are properly concerned with malignant influential on social media, learning to see is a powerful way to close the “advice gap”.

How can this be translated into older savers that have cash that they have never invested? Only 9 percent of the UK consumers have taken financial advice over the past year. Although ads for Actions and Sharing Isa are full of statements of responsibility for the risk of investment and end with less money than you started, the risk of having too much cash for long periods is poorly understood. Cash is not warning about inflation that erodes their expense power over time or the investment returns you could lose.

The response lies in loosening the regulatory counseling guidance limit and allowing financial suppliers to give their customers “directed support”. This aims to overcome the gap between the full financial councils and the general guidelines, taking into account the client’s goals and financial circumstances and pointing them to a suggested investment solution. I think this will be a change of game to light new investors, but it is at least 18 more months.

Instead of adding complexity by limiting future tax reductions to UK shakes, there is a convincing evidence that the extension of investors will increase the income of the United Kingdom naturally due to the home bias of investors.

The British market can only make up about 4 percent of global capital rates, although 50 percent of the assets Isa that Hargreaves lansdown and Aj Bell platforms have investments in the United Kingdom (both actions and funds). At Rival Interactive Investor is just over 25 percent.

Another incentive would be to get rid of the duty of stamp of UK shares. Aj Bell estimates that doing this for investors Isa would cost £ 120 million, which are peanuts in the great scheme of things.

Finally, the Chancellor should not hurry. The constant change of the rules that regulates the long -term investments destroys confidence in the system, as we have seen with the removal of panic pensions without taxes at the time of the last budget (I ask how much it sits on the cash accounts).

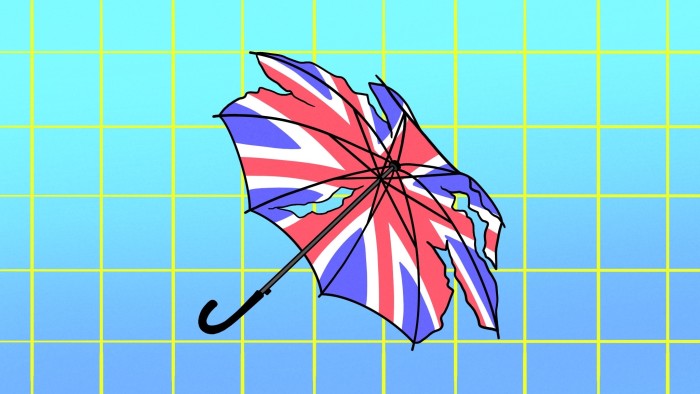

Building an investment culture will not happen during the night, but to destroy one, looking at Isas in restrictive legislation, it cannot cause what we have already built very easily.

Claer Barrett is the consumer publisher and author of the FT Sort your financial life Bulletin newsletters; claer.barrett@ft.com; Instagram and Tiktok @Claerb