Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

These two hidden stocks reproduce the subject of the AI/Data Center.

This data center team company and NVIDIA partner provide critical solutions.

This company aggressively increases its utilities and exposure to the data center.

Suppose you plan to invest a relatively small amount of money in actions in a diversified portfolio and seek to spread the risk while gaining an exposure to the reverse to an exciting growth topic. In this case, the AI/Data Center space is a good place to start. Verb (NYSE: VRT) and nvent (NYSE: NVT) You may not think of your mind when you think about it involving the expanding demand for artificial intelligence applications (AI) and, in turn, the expense of the data center. However, this observation highlights an opportunity for discerning investors to benefit. All three provide crucial solutions and services to data centers and represent hidden ways to reproduce the topic.

Vertiv provides digital infrastructure for data centers and communication networks, and their products include energy management, switch, thermal management and control and control infrastructure. Emerson Electric He sold the company to Tom Gores’s private capital company, Platinum Equity, in 2016, which later brought the company to market in 2020. Its executive chairman is a former long -term CEO. HoneywellDavid Cote.

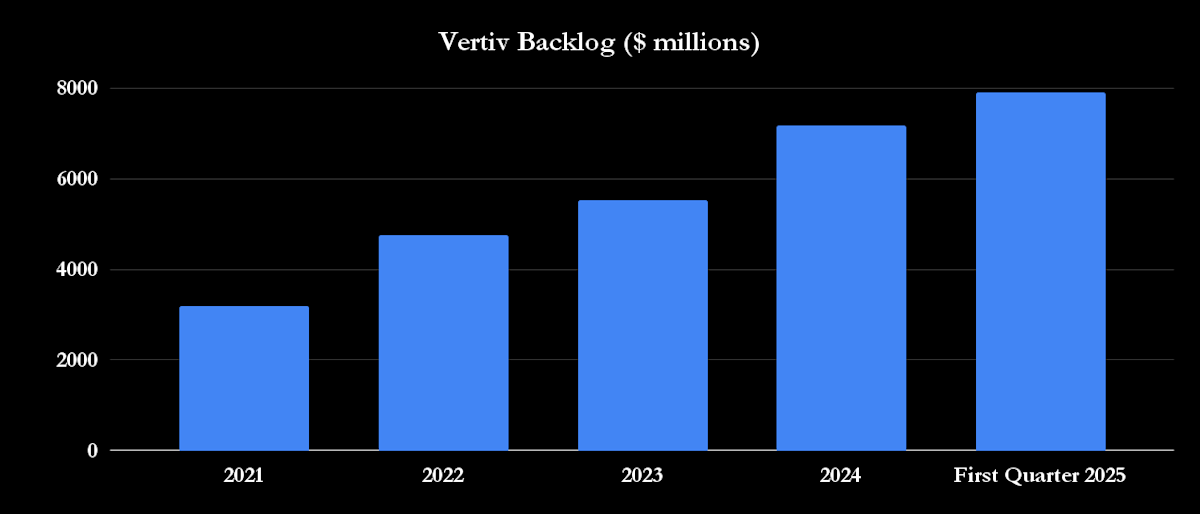

The company has been ideally located to benefit from the increase in interest in the data center’s investment to support the growth of applications, as it shows widely due to the growth of the boom in vertiv. This growth continued during the first quarter, with a decline of 10% compared to the end of 2024.

The strength in its orders and the growth of the ties encouraged direction to increase the average point of organic income growth forecast for a whole year to 18% from a 16% previous estimate in their recent earnings call for the first quarter.

However, the direction maintained the midpoint of its margin, benefit and cash flows due to uncertainty on the rates. Still, Vertiv and Wall Street management analysts wait $ 1.3 billion in free cash flow (Fcf) In 2025, and Wall Street waits for $ 1.65 million and $ 1.79 billion in FCF in 2026 and 2027.

With a current market lid of $ 36.1 billion, Vertiv would trade 28 times and 22.5 times FCF in 2025 and 2026. This is not excellently cheap, but it will seem a good value if the tendency towards accelerating AI/Data Center continues.

NVENT offers solutions of protection and electrical connection to various industrial, commercial and residential clients. These final markets include data centers and power utilities that generate energy to feed them. Management has made a conscious decision to increase the company’s exposure to these final markets by disinforming its thermal management business in January, and then completing the purchase of the electric products business of device infrastructure solutions for $ 975 million.