The leading heads of the country finally give their two cents on how the businesses, commercial wars, and economic tumult can affect business.

The prospects during the winning season should be the same for the course. But the industry has basically has been a mother From “Liberation Day”, directly talking about the results calls of the residential capital communities, the Avalonbay communities and the property of Camden, such a necessary novelty.

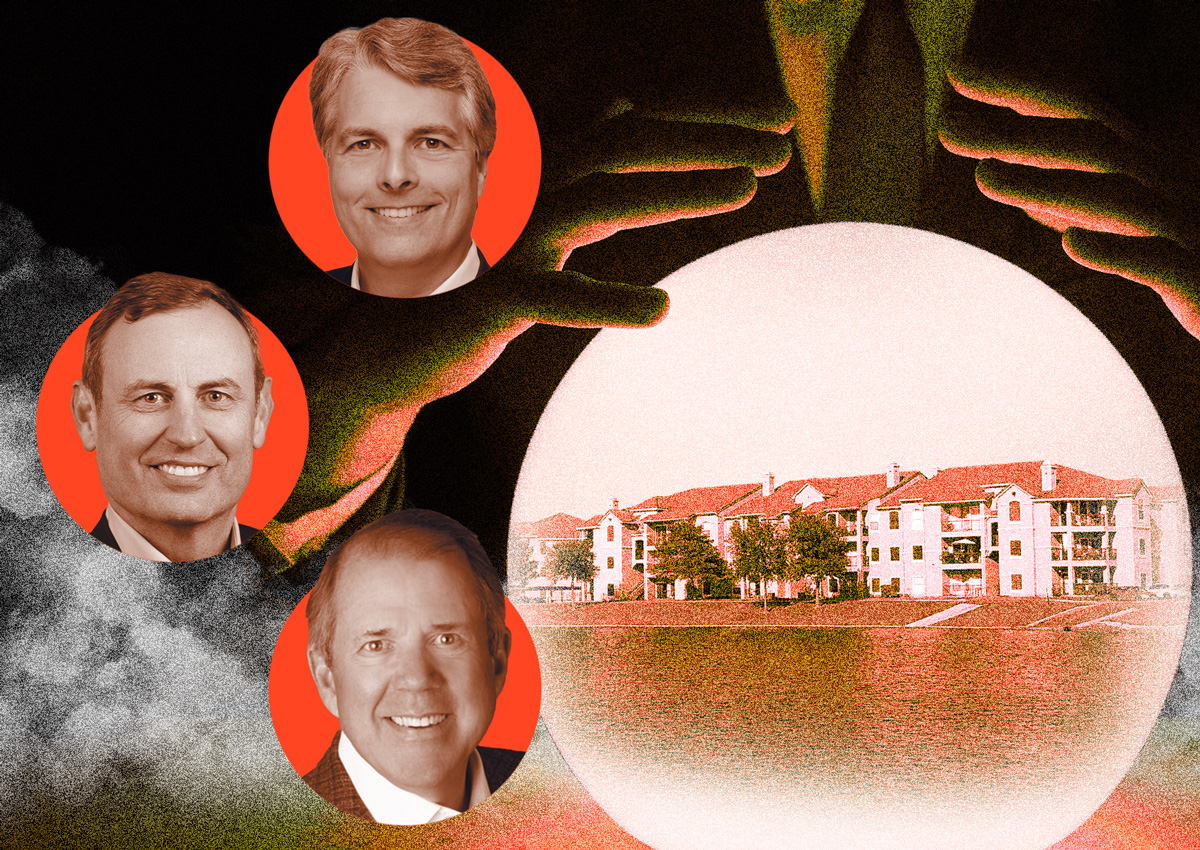

“You are like the only apartment that has talked about residents’ concerns so far,” said Piper Sandler’s analyst Alexander Goldfarb on Avalonbay’s Thursday call.

Execrs admitted the uncertainty of cloudy crystal balls. However, they shared what they could divine.

The result: The foundations of the market are solid and are ready to strengthen; The largest unknown is now the job market.

The three reit said that the demand is as robust as it is done, at least right now.

Mortgage rates and household prices are high, which has deterred buyers to leave leases and further press a underground housing market. In the meantime, the maximum rental season is in hand, creating a perfect storm for the owners.

The problem is the talk.

Avalonbay’s CEO, Sean Breslin, said the conversation of tenants, both potential and current, focused on: “Today I have work; I will have a job tomorrow?”

The Reit, based in Arlington, Virginia, has a multifamily in 12 states and, above all, Washington, DC, where the federal sweepering sweeps have marked the labor market and affected the durable fears among the still employees.

DC’s federal labor force is expected to reduce 21 percent until September 30, according to the district’s reselive analysis office, which now provides for the metro region to enter a slight recession at the end of the year.

Exchange the local lens for a national and 260,000 federal employees have left the labor force (by choice, force or some combination), as President Donald Trump took office, according to a Reuters May analysis.

Avalonbay will hear this absence. About 12 percent of their residents work for the federal government, Breslin said.

Neither the reit nor the companions of equity and Camden said that the layoffs had not reached the rental numbers. But the impacts usually manifest -six to eight months on the line, said Breslin; Equity’s CEO, Mark Parrell, echoed.

“We are a delay, not a main indicator of the changes in the economy,” Parrell told the firm’s Wednesday Wednesday earnings call.

“People, if they lose their job, do not immediately give us the keys.”

Right now, the tenants are entitled with these keys.

The equity registered a low turnover rate in the first quarter of 7.9 percent, said COO Michael Manelis. Camden reported 3.3 percent of pop renovations, one of the highest rates of the firm, said executive vice president Keith Oden.

This is good news for the moment. But it also indicates that tenants respond to uncertainty and difficult times can be on the horizon.

Breslin exposed the typical chain of events when economic perspectives became Dicey: tenants sink, and then cut off the “wishes” in their budget until they are forced to cut the “needs”, critically, rent.

The signs are there. The discretionary spending is down. It has been rushed since November 2025, according to Deloitte, although it is above the lows 2023 and 2024. And the tenants since February have reported costs planned for homes and public services, the signaling pocket books are being spicy.

“The probability of a recession remains in 60 percent,” JP Morgan proclaimed in his April report in Mitjans.

However, these Jitters are not yet wrinkled. Or so they claim.

“We do not see any sign of consumer weakness today,” said Manelis de Equity. When weakness appears, it manifests itself as broken leases, movements for lower rentals, less renewals and late payments.

“We have not had people who came and said,” My God, I lost my job in the federal government, you must leave me -to leave my lease, “said Ric Campo, CEO of Camden.

“We just didn’t see it.”

The good news, however, is that the supply story seems to be in the rearview mirror and, with the exception of an increase in unemployment, the decrease in deliveries should give the income a boost.

The first quarter marked the first time since 2021 that the tenants released the new units faster than the developers.

Last year, Washington, DC, pounded the largest excess apartment, compared to the demand for tenants, according to the real page. Then came Houston and Las Vegas.

The stairs are in favor of the owners in Dallas, Atlanta and Denver, the Capital Investment Director, Alec Bracenridge. Austin, Charlotte and Phoenix “have not caurated the bleeding of all the supply they have been,” he added, but decreases the signal of pipes that they can soon.

Austin, who has led the National Package in supply, produced fewer units that were leased in the first three months of 2025, in the first time in three and a half years he has registered a positive clean absorption, according to the MMG sliding.

The pipeline is still robust, but the construction slows “significantly into the posterior half of 2025,” said Camden’s camp.

After almost two years of negative growth, it is now expected that rental changes will be positive by 2026, according to Investments.

Groups like Avalonbay are committed to this sea change. The firm hired eight multi-family properties of Texas in the first quarter, two in Austin, the rest in Dallas-Fort Worth, for more than $ 600 million.

“Look at the base on which we can enter these markets,” said Breslin, who specified that the Texas Agreement had a $ 230,000 price. In comparison, prices per unit in Austin exceeded $ 275,000 during the last cycle.

Camden, Camden One-Buced, had an Avalonbay in Febraury, reaching Austin’s Emerson in Leander for $ 68 million or $ 192,000 in the unit, a 16 percent discount on its valued value.

Through the sun belt, ache than the maritime values of 2022 until last year work Its passage through the system and the investors who look at the change are leaving the margin.

“The lenders have only had it: they no longer expand their loans; they no longer extend the caps of the interest rates,” said Bracenridge de Equity.

S2 capital, for example, one of the multi -family unionists ride Fall of the Sun belt took a good piece of buildings owned Gva – A union that did not go well.

One of the biggest investors in the cycle, GVA has lost dozens of assets Mortgage execution and Forced sales After the interest rates were decreased in their floating type loans; faces multiple Investor dresses alleging shady treatment.

S2, in collaboration with Windmass Capital (a third union) collected one of GVA’s struggles Austin assets In January for $ 50 million. S2 also participated as a general partner in a GVA portfolio of 1,768 units with buildings in Dallas and Nashville, and Knoxville, Tennessee.

“We are seeing some more products that start in the market,” Brackengenridge emphasized. “At the same time, there is a lot of interest in buying this product.”

Equity Pentina Dallas, Denver and Atlanta for acquisition opportunities. Unlike his peers, Austin is not yet hungry.

“There is such a large supply, it is probably a little later for us,” said CEO Parrell.

The three reit, who bend as developers, said that the rates would press the expenses. Avalonbay estimated a jump of 5 percent of hard costs and said that the rise “could be enough to make known some projects to be unviable.”

“Even without any changes in the costs, it is very difficult to make the subscribed offers right now,” Brackenridge said. A mix of uncertainty and still high rates complicate math.

But as a new development activity dries, contractors and subcontractors are more willing to reduce prices, which is to compensate for the highest price of materials, according to executives.

“The contractors (they are very hungry,” Brackenridge added. “They see that the pipeline decreases and therefore accept less a margin.”

Avalonbay, who acts as his own contractor, said: “Our phones are ringing the hook with deepest supply coverage and stronger subcontractors availability than we have seen for years.”

“This is good,” said Matt Birenbaum, investment director.

This article originally appeared in the actual agreement. Click here To read the full story.