Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The key to generating a lot of dividend income is to increase your balance.

Investing in a larger stock market each week can be a good habit to start immediately.

Over time, your portfolio may increase by worth more than $ 1 million.

Finding money to invest in the stock market can be difficult, especially in the midst of inflation and rates. But if you can find $ 50 to leave the bag every week, you may be able to collect dividend revenue of $ 50,000 or more in the future.

Investing continuously in the market is a great strategy, given the strong probability that your portfolio will increase in value. And even though you may not think that it is worth a $ 50 investment per week, it can be one of the best habits you start this year.

Where to invest $ 1,000 right now? Our analyst team just revealed what they think are the 10 best stocks to buy right now. Continue »

The first thing you have to propose is to find some shares or a stock market (ETF) that you like and want to invest. In doing so, you can simplify your investment strategy because you do not have to worry where to invest your money every week. If the process is too annoying, it will be harder to stay.

An ETF can be more suitable for this type of strategy. Since it will celebrate a diverse basket of actions, you do not have to worry about individual stocks. You can invest in various ETFs, but at least you should consider having an ideal fund like your default investment.

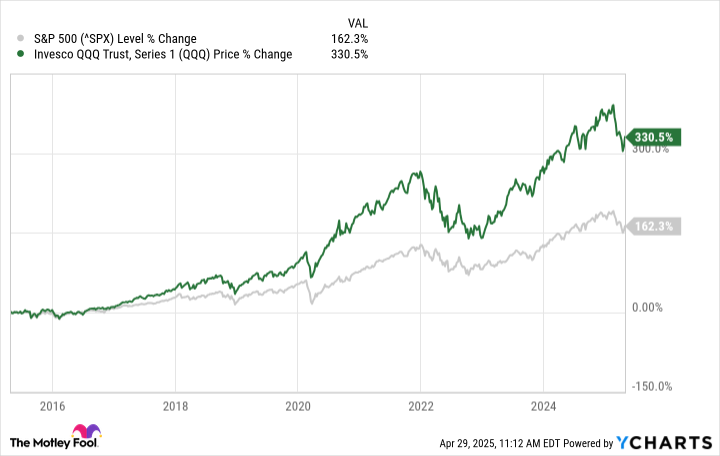

A great option is the Invesco qqq trust (NASDAQ: QQQ)which gives you exposure to the 100 best non -financial stocks of the Nasdaq Exchange. This means you can benefit from the long-term growth of many tops Growth stockseven Nvidia, Microsoftand Apple. For the last decade, this ETF has overcome the market.

Through the power of the composition, an investment of $ 50 per week that has a 10%growth rate, which is in line with the S&P 500’s average long termcan lead to a significant balance later. Then shows the maximum that this balance can be if you continue to invest every week for another 30 years.

|

Balance of future portfolio (investment of $ 50/week) |

|

|---|---|

|

Year |

Annual growth of 10% |

|

30 |

$ 495,673 |

|

31 |

$ 550,488 |

|

32 |

611,062 dollars |

|

33 |

$ 678,000 |

|

34 |

751,970 dollars |

|

35 |

$ 833,713 |

|

36 |

$ 924,044 |

|

37 |

1,023,865 $ |

|

38 |

1.134,174 $ |

|

39 |

1,256,073 $ |

|

40 |

1,390,779 $ |

Author calculations.

To ensure -you generate $ 50,000 in annual dividends, you will need a balance of about $ 1.1 million. To generate a lot of income, the target investments that produce about 4.6%; You do not have to look for high -performance dividends, which can often lead to significant risks. And, to be clear, this money can and probably have to be extended by several investments that pay 4.6% on average, you probably don’t have to put all your savings in a single stock or ETF.