Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The rates could eat billions of the background lines of car manufacturers.

General Motors published a strong quarter, overcoming estimates.

But he suspended the purchases of shares and has obtained guidance.

All eyes and ears are lit Automobile manufacturers“Earnings call to try to collect suggestions or details on how companies will try to mitigate the rates. The Trump administration implemented tariffs that included a 25% tax in imported vehicles and extend to the automobile pieces imported in May, although there seems to be modifications to the rates.

With this configuration, here were three important bins General engines‘ (NYSE: GM) Awesome first quarter.

Where to invest $ 1,000 right now? Our analyst team just revealed what they think are the 10 best stocks to buy right now. Continue »

Investors knew that General Motors had a strong quarter after seeing his sales report and his financial results did not disappoint. General Motors reported $ 2.78 to earnings per actionEasily overcoming the estimates of analysts asking for $ 2.70. The income increased to $ 44.02 million, and also exceeded the estimates of analysts asking for revenue of $ 42.85 million.

The bad news is that the rates are expected to cause immense pain. According to Barron’sAnalysts provide that the impact of rates on GM benefits range is between 30% and 100% of operating income, this is a serious business.

Management wants to have a crystal ball to help predict the fare impacts, but with the lack of certainty on the subject, General Motors chose to remove its prior orientation.

“We believe that the future impacts of the rates could be significant, so we are evaluating our orientation and we hope to share more when we have greater clarity,” said GM CFO Paul Jacobson during a call to the media. “You cannot rely on previous orientation and we will return to the market clearly as soon as we have it.”

The good news is that while possible impacts could be devastating, The Wall Street Journal It was reported on Monday that the Trump administration will soften the impact of automobile rates. The car industry could use the relief, as its supply chains are globalized, complex, and to take immense time and effort to radically change to prevent rates.

In equally positive news, Jacobson also said that the car maker believes that he can compensate between 30% and 50% of North -Americans.

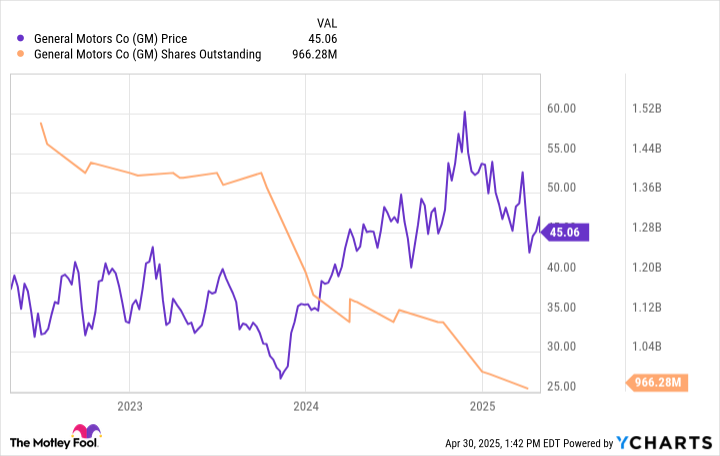

One thing that General Motors has done extraordinarily well in recent years is to buy its shares undervalued at a high rate. At the end of 2023, the company announced a purchase of $ 10 billion and early next year announced an additional authorization of $ 6 billion. In fact, GM has dramatically reduced its actions over the last decade and its price of shares, as you can see, has reacted positively.